Utah’s public education system is a paradox of financial numbers.

Like all states, public education funding is a complex system of taxes, formulas, special programs and expenditures.

But Utah has one thing no other state has. Utah actually spends more of the state’s budget and more taxpayers money on education than any other state in the union.

Utah also ranks last among states in the amount spent per student.

The average median age of a Utahn is in the late 20s. That means there are as many Utahns younger than 27 as there are older than 27.

In addition, Utah has more than 21 lives births per 1,000 population per year. Texas ranks second with slightly more than 17 per 1,000 per year.

Utah has 483 public school age children for every 1,000 in population while the national average is 402.

The Utah Legislature and educators must face the paradox every year as the budget is hammered out for the state. It is also a problem for local school districts that are growing or waning.

In the case of Carbon School District, the population in the local area is going down yearly and so is the number of students. The fall enrollment for 2005 was 3,389. The year before, it was 3,488. In 2003, it was 3,622. The current projection estimates that the district will have 3,337 students when the count is taken.

Declining figures hurt the district because a significant amount of the money a school gets depends on daily attendance. That means absences from school hurt financially because budgets are somewhat based on what the district will receive based on projected enrollment figures.

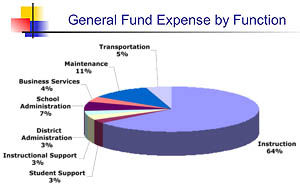

In addition, school districts have fixed costs. Since salaries constitute 64 percent of the districts budget, one way to cut costs is to reduce the number of staff and teachers when enrollment goes down. Carbon has done that, and in fact did it this year as well. The reductions also cut benefit costs as well. But the cuts affect the community and certainly individuals who either lose positions or when the positions aren’t filled, a good paying job for a county resident who would require goods and services from private businesses.

But the district has a difficult time discarding some fixed costs. Facilities cost a lot to operate and closing a school is not cheap. Many school buildings in the district are operating under capacity. But the costs to maintain and run the facilities is almost as great as when schools are full of children. Yet, schools can be the center of communities and important to almost all local residents.

Revenues for school districts are committed during the budgeting process to various kinds of expenditures.

Some revenues are mandated to be used for certain purposes, such as federal money for certain programs. In other case the district has leeway as to what dollars go where.

In the case of Carbon District, as noted in an article earlier in this series, a number of different funds have revenue committd to them, including:

•A general fund, where the most money resides.

•A non kindergarten to 12th grade fund.

•A capital outlay fund.

•A debt service fund.

•A food service fund.

•A school activities fund.

•A fund for the Southeastern Service Center.

The general fund is the one that is used for most of the general school programs. It funds nearly all the salaries for regular employees of the district including teachers, administration (both at the school and district level), paraprofessionals, counselors, secretaries, custodial and maintenance people. It also pays for any inservice training, supplies/textbooks, utilities, transportation, the libraries and special program grants.

The general fund is funded by property taxes, interest income from investments, state WPU (weighted pupil unit) monies, state programs and some from federal grants.

The non kindergarten to 12th fund is just what it sounds like. This fund supports many of the things that don’t have to do with regular school day programs such as extracurricular activities and athletics, recreation programs, pre-school programs and the ever-growing adult education program.

This fund derives its dollars from property taxes, fees collected from those who use the services, state and federal adult education funding as well as state and federal preschool program money.

Capital outlay funds exist in every school district. These funds are used for a number of hard supplies, equipment and facility purchases. Carbon uses these funds for property purchases, new construction of buildings or remodels, equipment and furniture, property repairs, computers and technology, buses and vehicles as well as some limited money for textbooks and supplies.

Capital outlay is supported by property taxes, interest from investments, special state funds earmarked for equipment, local funds that are generated by the sale of property or equipment and bond sale proceeds.

Most school districts have bonds that need to be paid off. These bonds often exist for a variety of reasons, but most generally for large capital projects that required financing over a long period of time. These funds are used to make those bond payments and interest payments on bonds and loans. The money for these payments comes entirely from property taxes, which can be adjusted, within certain limits, up and down by the districts school board to serve the needs of the debt.

The food service fund pays for the staffing of food services (including the administration of it), the food that is bought, the supplies that are needed and the equipment for the kitchens and supply chain. This is one of those cases wherein the school district receives special funds that must be used only in the area they are dedicated to. Funding comes from the food sales themselves (lunch and breakfast), state school supported lunch funds and federal lunch funding.

The school activity fund is totally funded by fees students pay at school and the Southeastern Service Center is funded by special state money just for them as well as federal grants, some of which are on-going. Carbon School District does not deal directly with the money for the service center, but acts as the bookkeeper for the agency.

Editors note: Today’s story is the third of four articles on public school system finance.

Funding, expenses go hand in hand at public school districts across Utah