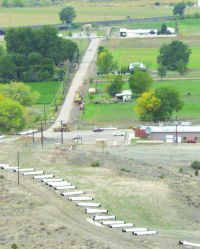

| Pipe for Price city’s water transmission project line the ground near1020 North below Wood Hill in October. With more than 30,000 feet of pipe being installed to the treatment plant in Price Canyon, the water line represents the type of project property taxes help support. Changing the funding by taking away property tax supports for the projects could have mixed effects on consumers, including significant monthly water rate increases to pay for the endeavors. |

Most Westerners in the know place a higher value on water than on land. Water wars in the west are legendary. Battles have erupted between regions, between states, between drainage basins, between towns and even between individuals.

In Utah, water wars have been varied. The districts that supply culinary water for users in an area have been in the middle of some of the battles. But in the next month, the districts may be fighting the biggest battle of all- not for water, but for the tax supports the suppliers enjoy in the state.

Few states support water districts with property taxes the way Utah’s system has. In some places, various other taxes provide support toward completing new projects and covering ongoing costs. But in most areas, users directly pay for the cost of the water and supply systems.

Gov. Mike Leavitt has called a special session of the Utah Legislature in December to deal with the huge deficit the state is facing.

The governor has said that higher and public education should remain harmless in the upcoming round of budget cuts, so he has centered his ideas for decreases in other areas.

One of the areas proposed by Leavitt involves cutting the existing property tax supports for water districts in Utah.

At first glance, the idea seems straight forward: make consumers who use the water pay the full price. Then the property taxes that are collected can be used to fund education and other services.

However, the proposal is more complicated than it appears at first glance.

A significant amount of the money that goes from an individual’s property taxes toward a district is not used to pay for the water, but to cover the costs of development and replacement of infrastructure.

“While I am no expert on this, the proposal is not as clear cut as it seems,” noted Rep. Brad King.

King represents two-thirds of the population of Carbon County in Utah House District 69.

“It appears all a proposal like that could do immediately is generate about $40 million. But ultimately, it could affect the $300 million revolving fund rural water district use for infrastructure,” pointed out King.

That means places like Carbon county and the rest of eastern Utah could be in line for a big jolt if all the funds were diverted.

Last week at Price River Water Improvement District’s regular board meeting, PRWID manager Phil Palmer addressed the question of what might happen should the Legislature decide to cut back or eliminate the property tax supports.

“Our state association is putting together some information for the Legislature and the public on this and it should be out next week,” indicated Palmer.

However, the association has not completed the task because the committees working on the proposals have not released any information on the bills that may be introduced to the Legislature.

“It’s hard for the association to respond to something that they have no specific information on,” said PRWID assistant district manager Jeff Richins on Tuesday morning. “They are just waiting for those bills to come out then there can be some reaction to them.”

But the while the issue of what might happen hangs in the balance, there are several facts and myths about water, districts and consumption in the state of Utah.

No one disputes the fact that Utah is the second driest state in the Union.

Utah is also one of the highest per capita users of water in the country.

Water conservationists complain about what they call diametrical relationship, yet it makes sense.

“If you are the one of the driest places, it would make sense that you use more water than somewhere where it is not,” pointed out Richins. “We don’t live someplace like Ohio, where it rains once or twice a week, so ultimately we use more water per capita than they would.”

When Utah was founded by pioneers, much of the water was used for irrigation and it still is.

According to a recent Utah Foundation report, 85 percent of the water is currently used for irrigation purposes. The remaining 15 percent goes to what is called municipal and industrial use. The pattern is basically repeated throughout the west.

Utah has always had the philosophy of making sure residents have enough water to take care of their needs.

In the early days, the philosophy meant that supply systems and irrigation were set up so individuals at the end of the ditch or newer claimants had the same rights to water as people at the top of the ditch or those with older claims.

With the philosophy came the idea of everyone paying to take care of water systems through not only rates, but taxes.

Recently, proponents of eliminating the property tax funding supports began doing comparisons with other states and how the water districts operate.

However, how districts operate in an atmosphere of modern law and cooperation may be different from what many suppliers faced in the past when the water systems were originally put into place.

Many out of state districts may not use property tax supports for daily operations, expansion or replacement.

But in the past, at least some of the districts charged significantly higher rates when water was cheaper to pay for the improvements.

After examining annual financial reports of water districts in the state earlier in the year, the Utah Foundation found that 50 percent of the operating budgets for some systems came from tax revenues. The water districts indicated that tax revenue income insured the highest bond rating possible.

The state’s overall cooperative spirit regarding supplies has led the majority of Utahns to view water as a right. But in many places, water is a commodity and the highest bidder gets the drink.

Arguments on both sides of the issue of whether taxes should be used to support lower prices for all individuals involved in a water system abound.

But changing how the funding is handled could not only have drastic impacts on water users in Utah, but could also present sticky questions about the systems that have assumed long-term debts through tax supports.

“Many water districts, like ours, have general obligation bonds that are long-term and being paid for by taxes,” pointed out Richins. “What will happen if suddenly the state pulls away that support? Where will the money come from to pay those debts that were approved by citizens in an election?”

There is the possibility that the Utah Legislature could make the withdrawal of tax supports apply to only the future. But that option would not accomplish what the governor is looking for – a solution to the short-term problem of cash flow and generating additional revenues for the state budget.

Another side consequence of the tax support elimination action would take away the ability of many state agencies that currently lend money on water projects to continue to enter into the transactions.

It would not only dry up the funds, but could affect bond and loan ratings so that the state agencies could not secure the revenues to help the water districts with monies needed to proceed with improvement projects.

Any kind of change in the present water district funding procedure could negatively impact rural areas throughout Utah.

Rural areas primarily obtain the money to cover the costs for water system improvement projects from the state lending agencies as well as from bond elections.

Sen. Mike Dmitrich doubts that a similar proposal would pass the Utah Legislature.

The Carbon County native represents District 27 and serves as the minority leader in the Utah Senate.

“A bill like this was introduced before and it went now where,” commented the state senator during an interview on Tuesday afternoon. “I don’t think it would have much support.”

Dmitrich spent the summer working with the members of the Utah Senate’s natural resources committee on a similar proposal.

The group had some of the best water people in the state on represented on the committee, according to the senator.

Last week, the representatives on the natural resources panel presented the bill to the members of the state’s water development committee.

“We told them that things should remain status quo,” pointed out Dmitrich. “There is just no way to do this without creating some big problems.”

However, the state sentator indicated that he did not believe the governor was going to let the idea die.

“There is the possibility that they may take out the sales tax that supports water districts (one-16th of one percent), but that would not generate much money,” indicated Dmitrich.

“That only provides $17 million to the state fund and some of that money is used for other things like dam repair, etc. Only $8 million goes into the revolving fund for water projects,” explained the senator.

During the regular session of the 2003 Legislature in January, a bill on water conservation could be introduced and could very well pass the Utah House of Representatives as well as the Senate, according to Dmitrich.

But the passage would not directly affect the existing revolving fund.

If the Legislature endorces a bill taking away even part of the financial support currently provided by property taxes, the action would definitely impact consumers and increase water rates in many places across Utah. However, the potential effects can only be evaluated when the particulars of any proposed bill are laid out on the table.