With April 16 deadline for filing taxes behind local citizens, Voices for Children of Utah put out a press release questioning just where our tax dollars are going.

The release put forth the following questions, does the tax system help create and maintain the quality of life everyone wants? Do citizens have the public structures in place in order to have the prosperity and quality of life they all expect? And, are tax dollars being spent in a way that ensures long term maintenance and stewardship of the things all consumers and citizens depend on?

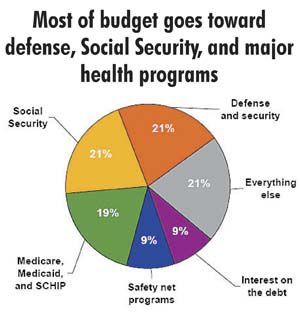

According to the Center on Budget and Policy Priorities all told the federal government spent a bit less than $2.7 trillion dollars in fiscal year 2006, representing about one-fifth of the nations gross domestic product. As shown in the graph, about three-fifths of the federal expenditures went to three areas, each of which comprised about one-fifth of the budget.

•Defense and security: In 2006, some 21 percent of the budget, or 557 billion, went to pay for defense, homeland security and security related international activities. While more than $100 billion went to support operations in Iraq and Afghanistan, the bulk of the spending in this category reflects the underlying costs of the Department of Defense and other security-related services.

•Social Security: Another 21 percent of the budget, or $549 billion, went to Social Security, which provided retirement benefits averaging $964 per month to 34 million retired workers in the last month of the fiscal year 2006. Social Security also provided survivors’ benefits to 6.6 million surviving children and spouses of deceased workers and disability benefits to 8.5 million disabled workers.

•Medicare, Medicaid and the State Children’s Health Insurance Program: Three health insurance programs-Medicare, Medicaid and SCHIP together accounted for 19 percent of the budget in 2006, or $516 billion. More than three-fifths of this amount, or $330 billion, went to Medicare, which provides health coverage to more than 40 million people who are over the age of 65 or have disabilities. The remainder of this category funds Medicaid and SCHIP, which provides health care or long term each month to an average of almost 54 million low income children, parents, elderly people and people with disabilities.

When it comes to education and the children in our society only 4 percent of the total federal budget accounts for spending on their education. This category includes training, employment and the social services function of elementary secondary and vocational education programs. Also included here are higher education, research and general education grant dollars.

For every dollar of federal tax revenue spent about 20 cents is spent on children and that is assuming that all income security goes to families with children. Of that 20 cents, 4 cents is spent on health, 6 cents on income security, 5 cents on education, 3 cents on nutrition and 2 cents on housing.

“Our economic future and the future of our democracy depends on what we provide for our youngest citizens, but who do we spend the least on…?” concluded Sarah Wilhelm, Fiscal Analysis Director at Voices for Utah Children.

Where do our tax dollars go?

kelly