In more than 100 years of public schools in Utah, funding vehicles to run the institutions have changed greatly. Originally schools, which were often held in churches and were funded by donations and tuition paid for by students who wanted to attend. At the time there was very little state funding other than some in-kind help, little local governmental support and absolutely no federal dollars involved.

Most schools were poor, not only in terms of dollars but what they could offer students. “Reading, writing and arithmetic” were what was taught because that was about all that the small independent schools could afford.

Today schools count a number of sources for funding, including large amounts of money from the state and federal government.

Carbon School District, along with the rest of the other 40 school districts in the state are funded by what is called the “Minimum School Program.” There are many components to the support system for education, and over the years there have been various attempts to “equalize” funding for public schools across the state.

The equalization process has led to some large changes in funding amounts for districts. But even bigger changes have taken place in the way that they are funded.

The foundation grant is the basis for this funding. Each year the foundation grant is set by the Utah State Legislature within the confines of the weighted pupil unit. The weighted pupil unit, which was put into effect in the late 1940s and early 1950s was one of the largest equalization attempts. Because the state controls the purse strings in the minimum program, local power to control schools was diminished, a precedent which many people regret today. The stability of what the legislature will grant school districts from year to year can vary, which creates headaches for financial administrators.

“When most of the revenues for schools were based on property taxes it was much easier to predict what we would have each year,” says Bill Jewkes, the business manager for Carbon School District. “Now we are never sure. The legislature determines so much of what we get from year to year, it is more difficult to predict what will happen.”

There are also other major funding sources, the largest being the ability of a school district to collect property taxes. However, what a school district can assess is set by the state legislature, so in a sense the state also controls that area of funding.

In the days before funding reform, districts largely ran their public schools on property tax revenues. Wealthy districts, where industrial and commercial development were prevalent, were always at an advantage. Poorer districts, often rural public education systems, did not have enough money to run the schools properly.

That dichotomy, is one of the things that led to funding reform.

However, even smaller districts sometimes miss the days when local officials were more in control of the monies they could raise.

Today, wealthy districts are still wealthy, but there is a limit to what they can collect for their district and anything above that amount is put into Utah’s uniform school fund through a program of “recapture.”

The recaptured money then goes into the uniform school fund and is used for districts around the state the next fiscal year.

The state’s uniform school fund also has a lot of money in it that comes from income tax.

The program of supporting schools financially has put the state in the position of controlling the bulk of the funding for public schools in Utah.

The money is all earmarked for basic school funding and has little to do with paying for other things such as special education, adult education programs, alternative schools, special and applied technology programs and other programs such as reducing class size and others.

In mid to late July, Carbon residents begin to receive preliminary tax bills on real estate they own within the county.

The mailings are labeled “Notice of property valuation and tax changes.”

The typical unincorporated county residents have already received their property tax notices for the current year.

The tax notice supplies information to the owner on where the money he or she will be paying in taxes goes for the year.

When taxes go up, people usually blame the county because they are the ones that send out the notice, but examination of the notices will show the entity that actually increased taxes.

The county is basically only the billing and collection agent for much of what people pay.

In the unincorporated area taxes may be assessed for the county itself, assessment and collection fees by the state, a water district, an improvement district, a county municipal service fund and two taxes related to education.

One of the assessments, the school district taxes, is usually the largest single amount on the notice.

For a home assessed at $118,000 the property taxes that go to school district add up to $315.

The other tax that appears on the notice is for the basic state school levy.

The tax is a state mandated levy for property owners to participate in funding the weighted pupil unit.

On the same $118,000 house, the assessment will be $105.

With the total property taxes on the $118,000 home registering in the vicinity of $690, the established guidelines mean that $420 of the bill will go to education.

The school funding figure represents more than 60 percent of the taxes paid by the property owner on the $118,000 home.

But the basic school program funding supplies less than 50 percent of the support that districts need to run.

School districts operate from a number of different funds, many of which are generated in different ways.

And Carbon School District is not exception to that trend.

For the local district the funds include:

•A general fund, the largest.

•A non-kindergarten to 12th grade fund.

•A capital outlay fund.

•A debt service fund.

•A food service fund.

•A school activities fund.

•A fund for the Southeastern Service Center.

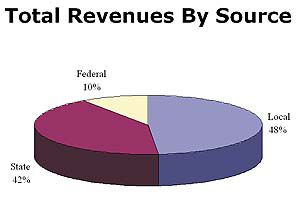

Revenues to support the funds come from many sources other than the uniform school fund.

Other sources of income include a dozen different feeds, with some money being earmarked specifically for designated expenditures.

Editors note: Today’s story is the second of four articles on public school system finance.

Minimum school program is basis for education funding