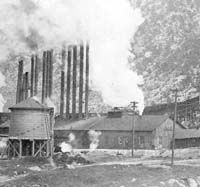

| Smoke billowing from the stacks at the coking ovens in Castle Gate and Sunnyside serves as a symbol of Carbon County’s thriving coal mining industry in the early 1900s. But the local coking operations faded from the region after companies started contracting directly with Geneva Steel and plants operating outside the area for the coal produced by underground mines in Carbon County. Constructed in 1944 during World War II by the federal government, the Geneva Steel mill permanently closed operations in November 2001 and the plant is currently being dismantled piece by piece. The furnaces, stoves and stacks stood as a landmark along the horizon in Utah County site for 61 years. |

Utah ranks behind only three western states in terms of expanding employment levels- Nevada, Arizona and Oregon.

Utah registered 3.8 percent job growth rate in first quarter 2005 for the best level posted statewide in nearly a decade, noted the latest Trendlines report released by the department of workforce services.

Utah’s job growth is driven by expansion of existing companies and businesses relocating from other states, reported the Federal Deposit Insurance Corp. reported.

Last week, Gov. Jon Huntsman officially unveiled a plan to nurture six economic “clusters.”

Utah will develop an integrated, focused statewide approach to fuel economic growth around the clusters, explained the governor.

As part of a larger economic strategy, Huntsman said the clusters will align businesses, workers, capital, education and government around targeted industries

On a negative note of local interest, the Geneva Steel mill is currently being dismantled piece by piece. Geneva Steel played a key role in Carbon County’s coal industry after being constructed by the federal government during World War II .

The furnaces, stoves and stacks stood at the Utah County site for 61 years.

Geneva operated under the ownership of several companies from 1944 until the steel mill’s final shutdown in November 2001. There was a temporary closure at the plant in 1987.

The steel production facility employed about 1,400 workers when the operation closed in 2001.

In addition, ending June 25, the four-week average of initial unemployment insurance claims filed at locations across the state registered at 1,172 .

The number represents an increase of 1 percent from last year’s four-week average of 1,160 initial filings for unemployment benefits.

The number of all initial unemployment benefit claims filed during the week totaled 1,064.

Weeks claimed by unemployed Utahns numbered 9,912, decreasing 17 percent compared to 12,000 last year.

At the national level, residential construction and stronger exports helped the U.S. economy expand at a faster-than-expected 3.8 percent annual rate in the first quarter, the Commerce Department reported. Initially, the department said gross domestic product – the broadest measure of total economic activity within U.S. borders – grew at a 3.1 percent rate but it pushed that up to 3.5 percent a month ago before finally revising it to match the 3.8 percent rate posted in the closing quarter of 2004.

The manufacturing sector expanded at a faster-than-expected pace in June as new orders to factories picked up. Activity at the nation’s factories increased for a 25th consecutive month, according to figures from the Institute for Supply Management (ISM). The June upturn followed six consecutive months of slowing growth in the sector. ISM’s manufacturing index registered 53.8 in June, up from a reading of 51.4 in May. A reading of 50 or above in the index means the manufacturing sector is expanding.

Consumer spending was flat in May, coming in slightly weaker than expected, while a key gauge of inflation also held steady. The Commerce Department said personal income increased 0.2 percent, the weakest reading since January and below economists’ forecasts for a 0.3 percent gain. That followed a 0.6 percent advance in April. The price index for consumer spending, a measure of inflation favored by Federal Reserve Chairman Alan Greenspan, was unchanged after rising 0.4 percent in April.

Federal Reserve officials are beginning to suspect that the perplexing decline in long-term interest rates is more than a temporary aberration. The possibility has major implications for the economy, and it creates new puzzles for Fed officials on how they should respond.

U.S. consumer confidence rose to a three-year high in June, buoyed by a more optimistic view of the labor market. The Conference Board said its gauge of sentiment rose nearly three points to 105.8 from a revised 103.1 in May.

Skyrocketing housing prices are driving people from San Francisco, Boston and other big cities. Warm weather and more affordable living are behind the rapid growth in midsize cities in Florida, Arizona, Nevada and California. Census Bureau figures show no letup in the migration to the South and West, which are home to all 10 of the fastest-growing cities with at least 100,000 people.

The biggest real estate investment boom in U.S. history may be approaching its peak, a leading authority on the market said. Yields on commercial property, known as cap rates, fall as prices rise in the same way that bonds move. The rates have been tumbling and prices have set record highs for some sectors as a wave of investment capital has moved from stocks and bonds into real estate.

U.S. Treasury Secretary John Snow acknowledged that record high oil prices are beginning to take their toll on the U.S. economy, but not enough to derail the economy’s strong recovery. When Iraqi tanks thundered into Kuwait in August 1990, oil prices doubled, car sales tumbled, recession hit the United States and crude costs retreated within a year as a result of a slump in demand. As oil tops $60 a barrel, people wonder if a re-run is on the cards � firstly whether recession will strike again and secondly whether that is the only way prices will abate. Heating oil prices trading in New York are up more than 60 percent from a year ago as concern about worldwide supplies and higher crude oil prices have driven up costs. Utah continues to add jobs at a blistering pace, second only to three other Western states – Nevada, Arizona and Oregon. Utah’s job growth of 3.8 percent in the first quarter of the year – the best in nearly a decade – is driven by expansion of both existing companies and those from other states, the Federal Deposit Insurance Corp. reported.

Provo, one of three Utah cities that in 2003 had a population of more than 100,000, has dropped from the U.S. Census Bureau’s 2004 list of large cities. That means Salt Lake City and West Valley City remain Utah’s only two cities with populations greater than 100,000, according to new Census Bureau population estimates. Meanwhile, smaller Utah cities � many in southwestern Salt Lake County or northwestern Utah County � continued to drive much of the population growth along the Wasatch Front from July 1, 2003, to July 1, 2004. Southwestern Utah is also seeing strong growth, with an influx of 3,256 individuals into St. George and 1,003 into the nearby city of Washington.

Last wee, Gov. Jon Huntsman officially unveiled his plan to nurture six economic “clusters,” around which he said the state will develop an integrated, focused approach to fuel economic growth. As part of his larger economic strategy, Huntsman said the clusters will align businesses, workers, capital, education and government around targeted industries.

A massive energy bill passed by the U.S. Senate could eventually bring oil riches to eastern Utah, western Colorado and southwestern Wyoming. Whether that happens in two years or 20 or at all will take more than an act of Congress, where the bill now moves for consideration.

Piece by piece, the Utah County Geneva Steel mill is being dismantled. The furnaces, stoves and stacks stood for 61 years, built during World War II by the federal government for about $200 million. Geneva operated under several owners from 1944 until its final shutdown in November 2001. There also was a temporary closure in 1987. The plant employed about 1,400 people when it closed.

As of the week ending June 25, 2005, the four-week average of unemployment insurance initial claims was 1,172. This represents an increase of 1 percent from the four-week average of 1,160 at this time last year. The number of all UI initial claims this week was 1,064. Weeks claimed numbered 9,912, decreasing by 17 percent over the same week (12,000) last year.

National Economic News

At the national level, home building and stronger exports helped the U.S. economy expand at a faster-than-expected 3.8 percent annual rate in the first quarter, the Commerce Department reported. Initially, the department said gross domestic product – the broadest measure of total economic activity within U.S. borders – grew at a 3.1 percent rate but it pushed that up to 3.5 percent a month ago before finally revising it to match the 3.8 percent rate posted in the closing quarter of 2004.

The manufacturing sector expanded at a faster-than-expected pace in June as new orders to factories picked up. Activity at the nation’s factories increased for a 25th consecutive month, according to figures from the Institute for Supply Management (ISM). The June upturn followed six consecutive months of slowing growth in the sector. ISM’s manufacturing index registered 53.8 in June, up from a reading of 51.4 in May. A reading of 50 or above in the index means the manufacturing sector is expanding.

Consumer spending was flat in May, coming in slightly weaker than expected, while a key gauge of inflation also held steady. The Commerce Department said personal income increased 0.2 percent, the weakest reading since January and below economists’ forecasts for a 0.3 percent gain. That followed a 0.6 percent advance in April. The price index for consumer spending, a measure of inflation favored by Federal Reserve Chairman Alan Greenspan, was unchanged after rising 0.4 percent in April.

Federal Reserve officials are beginning to suspect that the perplexing decline in long-term interest rates is more than a temporary aberration. The possibility has major implications for the economy, and it creates new puzzles for Fed officials on how they should respond.

U.S. consumer confidence rose to a three-year high in June, buoyed by a more optimistic view of the labor market. The Conference Board said its gauge of sentiment rose nearly three points to 105.8 from a revised 103.1 in May.

Skyrocketing housing prices are driving people from San Francisco, Boston and other big cities. Warm weather and more affordable living are behind the rapid growth in midsize cities in Florida, Arizona, Nevada and California. Census Bureau figures show no letup in the migration to the South and West, which are home to all 10 of the fastest-growing cities with at least 100,000 people.

The biggest real estate investment boom in U.S. history may be approaching its peak, a leading authority on the market said. Yields on commercial property, known as cap rates, fall as prices rise in the same way that bonds move. The rates have been tumbling and prices have set record highs for some sectors as a wave of investment capital has moved from stocks and bonds into real estate.

U.S. Treasury Secretary John Snow acknowledged that record high oil prices are beginning to take their toll on the U.S. economy, but not enough to derail the economy’s strong recovery. When Iraqi tanks thundered into Kuwait in August 1990, oil prices doubled, car sales tumbled, recession hit the United States and crude costs retreated within a year as a result of a slump in demand. As oil tops $60 a barrel, people wonder if a re-run is on the cards � firstly whether recession will strike again and secondly whether that is the only way prices will abate. Heating oil prices trading in New York are up more than 60 percent from a year ago as concern about worldwide supplies and higher crude oil prices have driven up costs.